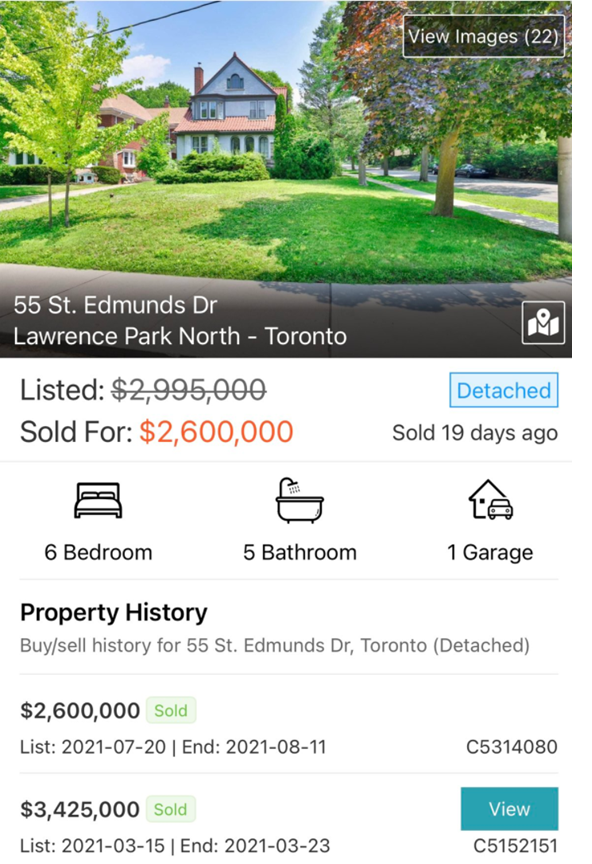

Over the summer of 2021 there was a sale that got the attention of a few mid town agents, it was a home on 55 St. Edmunds Dr in the coveted Lawrence Park neighbourhood that sold for $3.45M in March of 2021. A neighbourhood with a median price of ~$4.2M for 2021. At face value there was nothing notable about this sale or listing until the deal fell through and the property was relisted for...

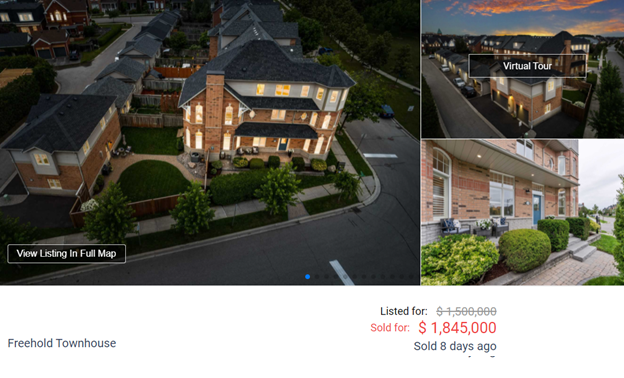

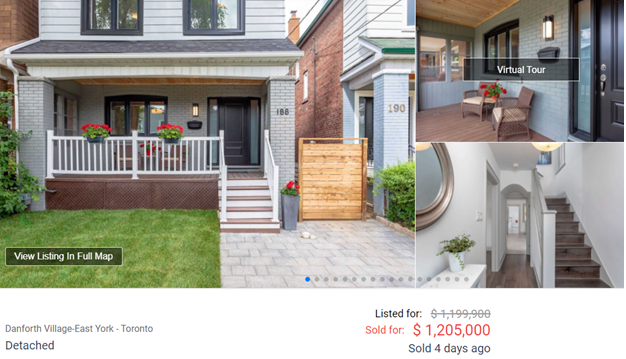

Earlier this week I posted 2 listings that I thought were great purchases based on current comparables, in this post I will post 2 listings that are the opposite, properties that have had substantial increases in the last 30-60 days where the Sellers walked away as the big winners as is the case with most transactions these days. Example 1: End unit Townhouse in Markham Freehold townhomes in the...

10 years ago I was under the impression that the real estate market was fairly efficient. I assumed for the most part everything was priced to near perfection and with the never ending supply of eager buyers it was like looking for a needle in a haystack when it came to good value. If there is one thing I’ve done a complete 180 on in the last decade, it’s this. Deals, whether ‘off...

The path of least resistance when it comes to multigenerational living is finding homes with layouts that lend themselves to minor retrofits where privacy can be achieved for 2 families. Finished basements with separate entrances being the most popular choice have an inherent problem as not many want to live in a basement long term. The following are alternatives that are gaining popularity,...

Pre Covid, the common theme when purchasing a home was to drive until you qualify, in other words, the further out you go from the Toronto core, the cheaper real estate was. Since covid this entire phenomenon has been turned upside down. With real estate assets at record highs and little in the way of cost savings by going further out of the Toronto core, the most common question I get from...

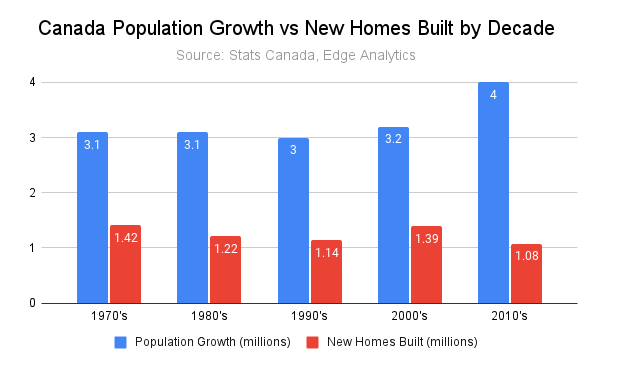

A trick question, it’s both, yet the elephant in the room doesn’t seem to get much attention. Interest rates being front and center when it comes to affordability, on the demand side – based on population growth, immigration is a massive driver for the ever-increasing real estate demand in the Greater Toronto Area. The GTA on average absorbs 35% of all newcomers to Canada yet new home...

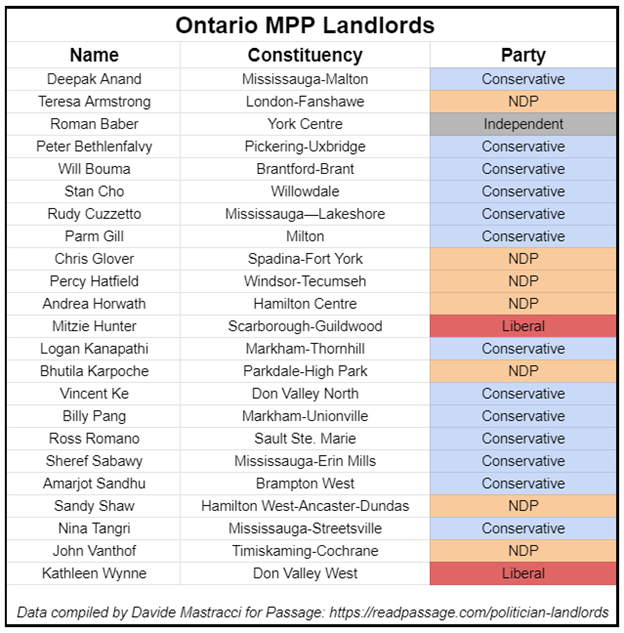

With the election upon us I came across an interesting article that publicly discloses our landlord politicians by province. Of the 124 MPPs in Ontario, 18.5% are landlords. The landlord group breaks down as follows: 48% are Conservatives, 33% are NDP, 14% are Liberal, 4% are Independent. https://readpassage.com/politician-landlords/ While I don’t believe any of the party promises will...

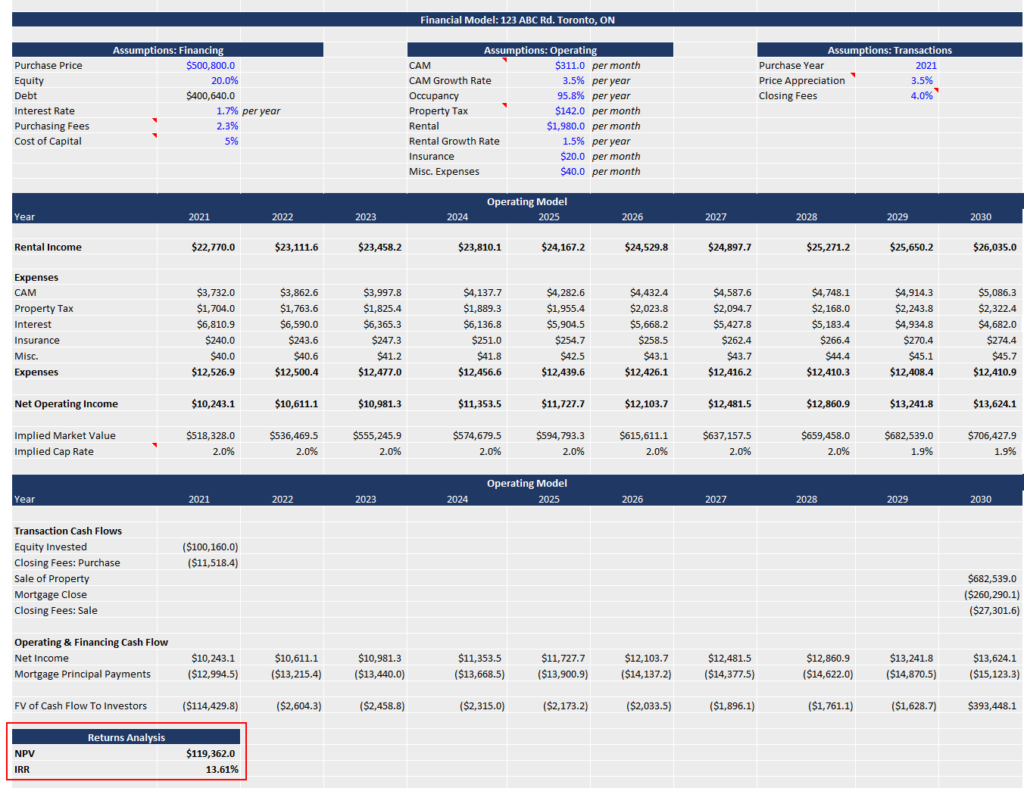

One of the most common concerns by those considering condos as investments is that rent doesn’t cover taxes/maintenance fees/mortgage, leaving them to subsidize the purchase and making the investment ‘cashflow negative’. A valid concern and something that was not the case up until a few years ago when capitalization rates on residential real estate became more suppressed. This model walks through...

Will we ever see pre construction projects in the Toronto core for less than $1,500/per square foot (PSF)? It certainly doesn’t seem like it. Assuming the government maintains its aggressive immigration targets and city hall keeps the status quo on its inability to process development applications in a timely manner, there are 3 main catalysts outside of government involvement that will push prices...