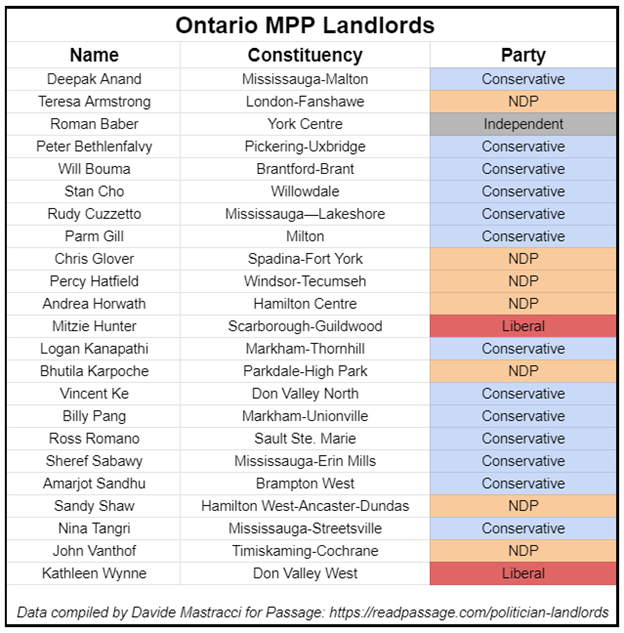

With the election upon us I came across an interesting article that publicly discloses our landlord politicians by province. Of the 124 MPPs in Ontario, 18.5% are landlords. The landlord group breaks down as follows: 48% are Conservatives, 33% are NDP, 14% are Liberal, 4% are Independent.

While I don’t believe any of the party promises will have a meaningful impact on real estate affordability, I did find the following promise interesting during an affordability crisis: “Capital gains deferral on investment properties if reinvested into another investment property”.

In the US this is known as the 1031 Exchange Rollover (currently on the chopping block by the Biden administration) – widely used by investors to accelerate the growth of their real estate portfolios. This exchange allows investors to defer taxes on investment properties by allowing them to reinvest the gains from current investments into new investments on a tax deferred basis.

Timing for such policy feels a little tone deaf when affordability is front and center and ‘investors/speculators’ have been the scapegoats, however it’s worth considering the benefits of the 1031 exchange as cited by US studies and how they can potentially translate here:

- Reducing the use of leverage

- Holding periods are shorter

- Higher CAPEX

- Improved liquidity

I’ve discussed opportunities created in the lulls of the real estate market before, I believe it’s important for current and future residential landlords to understand the implications of these election promises as they will be catalysts for short term price fluctuations and potential buying/selling opportunities.