Here is a real estate prediction worth listening to. My friend Jordon Scrinko of Precondo is one of the great resources in the space who provides solid and objective analysis of the condo space. Back in December of 2020 when we were in the thick of lockdowns, the condo market was at an all time low and no one was buying except a few brave souls. Jordon made a very contradictory prediction...

Business

For the past month articles like the one below have circulated blaming “Investors” for the increasing prices of homes in the GTA. This couldn’t be further from the truth, we are seeing a run up because people are capitalizing on pre approved mortgages with rates that were locked in prior to the recent increases. I had mentioned this three weeks ago and noted that it will likely have a...

Who is the builder? One of the first questions when evaluating buildings for a condo purchase. Builder reputation can ebb and flow, some have developed stellar reputations and command a brand premium for their buildings, old and new. Tridel being the prime example of the current gold standard. There are at least a dozen solid builders in the GTA, but there are just as many if not more that I...

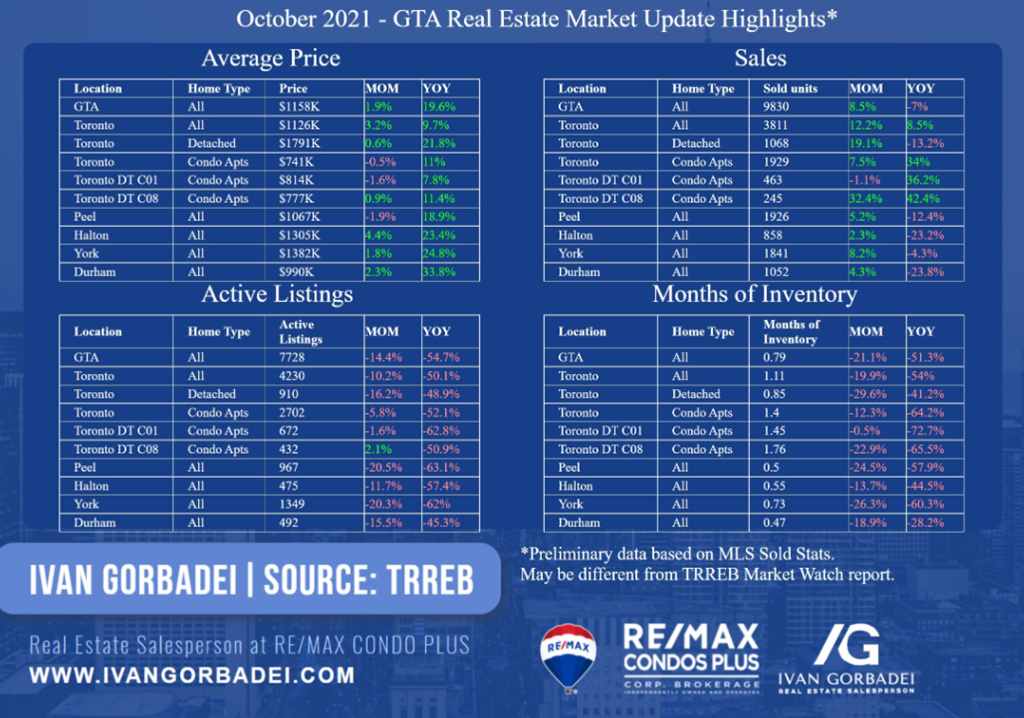

Every time we break a new record it seems there is no more room to go up, and yet here we are again looking at increasing price trends. Data prepared by Ivan Gorbadei shows all 4 leading indicators pointing towards higher prices. Aside from condos in the core there is further tightening in inventory. Prices are up and inventory is down month over month, making it an opportune time for sellers...

Some personal thoughts on how to think about downtown as an investor based on personal experiences. The downtown core as per The Toronto Real Estate Board is split into 2 Municipalities: CO1 (South of Bloor, West of Yonge, East of Landsdowne) and C08 (East of Yonge). For this discussion I will only focus on C01, west of Yonge. The C01 Municipality has 9 communities, of the 9, there are 3 where the...

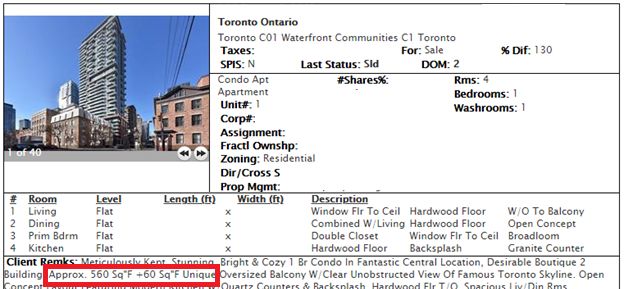

One of the nice things about purchasing a condo unit is that they are relatively straight forward to value. Your standard downtown condo will have a couple of hundred units with sales occurring with regular frequency. Comparables are readily available and standard adjustments to finalize valuations are based on floor, layout, condition, status certificate, views, etc. In this post I will highlight two...

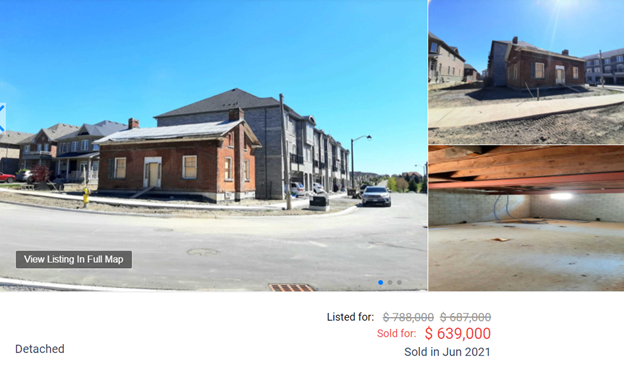

I have a theory on how to effectively ‘lowball’ within the real estate market, mostly substantiated by my own successes and failures with prior transactions. This strategy is exclusive to ‘stale’ listings, homes that have sat on the market for a few weeks with little to no traffic. Almost always this is a function of a property being overpriced and the seller not having realistic expectations....

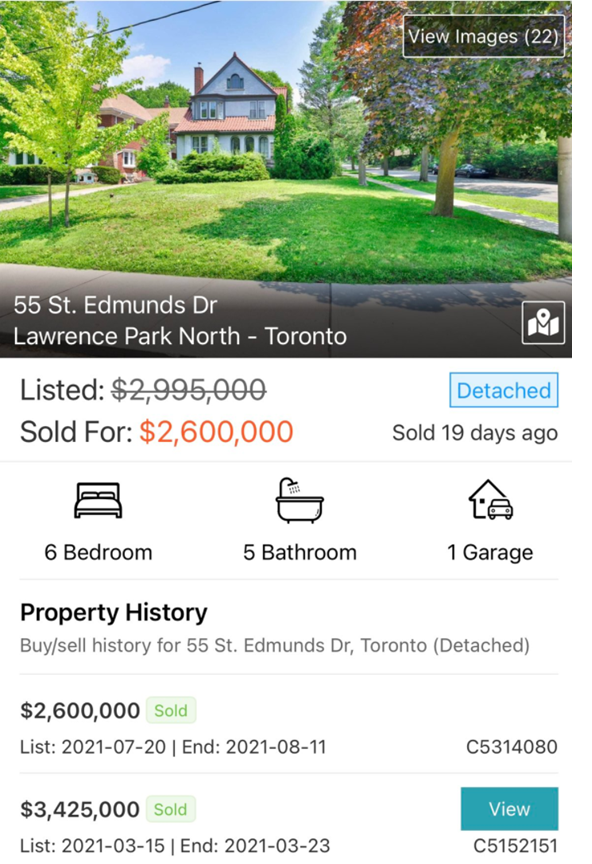

Over the summer of 2021 there was a sale that got the attention of a few mid town agents, it was a home on 55 St. Edmunds Dr in the coveted Lawrence Park neighbourhood that sold for $3.45M in March of 2021. A neighbourhood with a median price of ~$4.2M for 2021. At face value there was nothing notable about this sale or listing until the deal fell through and the property was relisted for...

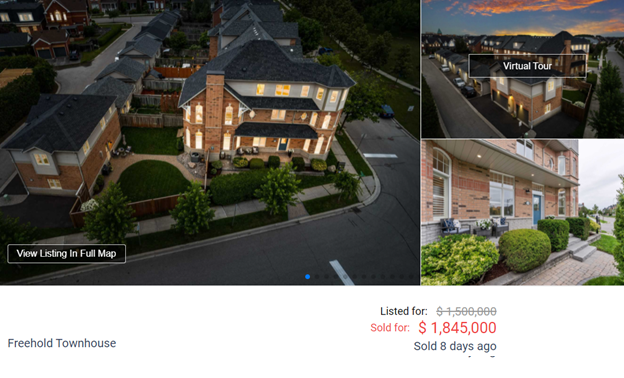

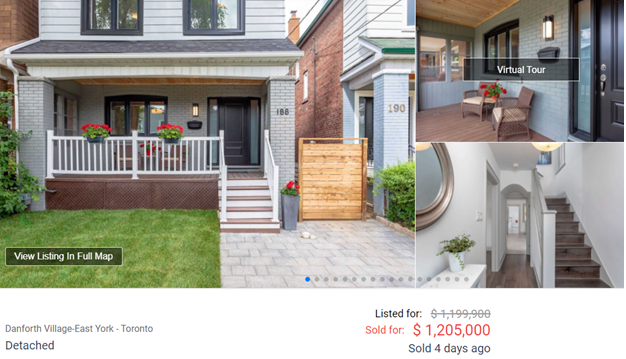

Earlier this week I posted 2 listings that I thought were great purchases based on current comparables, in this post I will post 2 listings that are the opposite, properties that have had substantial increases in the last 30-60 days where the Sellers walked away as the big winners as is the case with most transactions these days. Example 1: End unit Townhouse in Markham Freehold townhomes in the...

10 years ago I was under the impression that the real estate market was fairly efficient. I assumed for the most part everything was priced to near perfection and with the never ending supply of eager buyers it was like looking for a needle in a haystack when it came to good value. If there is one thing I’ve done a complete 180 on in the last decade, it’s this. Deals, whether ‘off...