I have a theory on how to effectively ‘lowball’ within the real estate market, mostly substantiated by my own successes and failures with prior transactions.

This strategy is exclusive to ‘stale’ listings, homes that have sat on the market for a few weeks with little to no traffic. Almost always this is a function of a property being overpriced and the seller not having realistic expectations. Generally speaking, this leads to qualified buyers skipping the listing or buyers putting in offers that the seller would consider as ‘lowballs’, a situation that is typically a waste of everyone’s time.

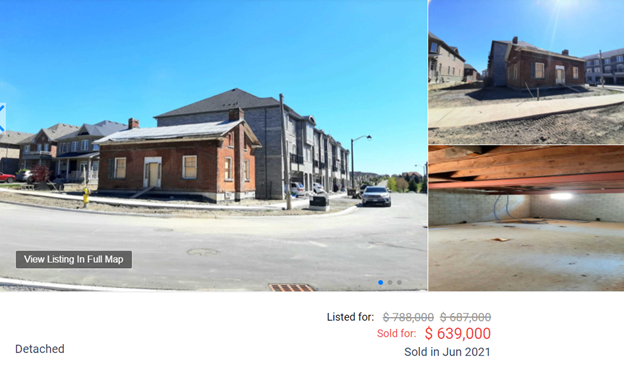

Using an example from this summer, a property I was personally interested in purchasing. A bit of an odd situation, an unfinished heritage home that had been listed by the subdivision builder came up for sale at $788k in an area where move in ready towns/semis were selling in the $1.2M range.

The economics made this ‘as is’ property worth ~$650k to me. After inquiring about the property and price expectations the sellers sat firm at $788k ask. This is where sequence of events matters. The first couple of people to ‘lowball’ the seller break the ice, generally these offers go nowhere, and in many cases both the buyer & seller walk away frustrated (I fell in this group). The opportunity stands with the 3rd or 4th person to come in with a similar offer. Sellers usually need to see at least 2 ‘lowball’ offers to adjust their expectations. This is where good rapport with the listing realtor is key to stay in tune with where the seller’s expectations are trending over time. Unfortunately, on this deal I was too early and not in the right sequence to be the 3rd or 4th ‘lowball’ offer. I was one of the first to break the ice for the following prospective buyers who ended up purchasing the property at an even steeper discount at $639k.