A trick question, it’s both, yet the elephant in the room doesn’t seem to get much attention.

Interest rates being front and center when it comes to affordability, on the demand side – based on population growth, immigration is a massive driver for the ever-increasing real estate demand in the Greater Toronto Area.

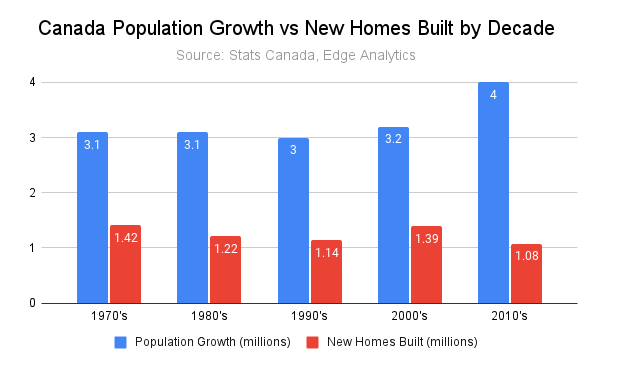

The GTA on average absorbs 35% of all newcomers to Canada yet new home completions are decreasing relative to prior decades while population growth is at all time highs. End result is above average price appreciation as we have seen in the last decade. An additional and more subtle factor over the recent past is the increase in single person households which has almost doubled since the early 80’s.

As of today, the government’s immigration targets for 2021 – 2023 are over 400k people/annually, ~20% increase since our record year in 2019 of 341k. Prior year government targets year over year were ~4%.

With aggressive immigration targets which are very likely to be met & possibly exceeded and an endless list of projects in gridlock at city hall and surrounding municipalities the impact on affordability and price direction is clear. Price and Rent increases to follow in housing that accommodates multigenerational living (large detached) and single person living (condos). #toronto#torontorealestate#realestateinvesting