I recently took over a listing from another Realtor that had 9 showings over 60 days, it did not sell. Upon relisting the home and adjusting the buy side commission, 7 days later the property was sold. CBC Marketplace recently did an expose on how some real estate agents behave in relation to lower than expected commissions. This segment generated a lot of heated engagement, it highlighted...

Uncategorized

As records are being set across the GTA on every property type, the premium paid for renovated homes appears to be growing disproportionately. In the past, premiums for renovated homes allowed buyers to save on time, stress, and lack of knowledge as it pertains to managing a renovation. The increase to the renovation premium in 2021 factors in a price hedge. The same renovation that cost $150k in 2019...

In my prior post I highlighted a listing that sold at substantial discount due to its heritage designation. These properties are widely misunderstood and, in many cases, undeservingly stigmatized. Oftentimes they trade at a discount because agents and buyers are unaware of the optionality and potential such listings have. As a result, over the last 5-6 years there has been a noticeable trend that has...

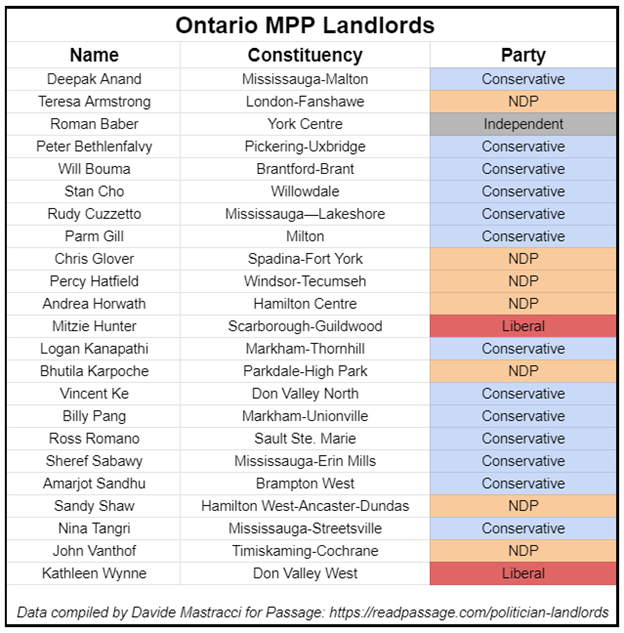

With the election upon us I came across an interesting article that publicly discloses our landlord politicians by province. Of the 124 MPPs in Ontario, 18.5% are landlords. The landlord group breaks down as follows: 48% are Conservatives, 33% are NDP, 14% are Liberal, 4% are Independent. https://readpassage.com/politician-landlords/ While I don’t believe any of the party promises will...

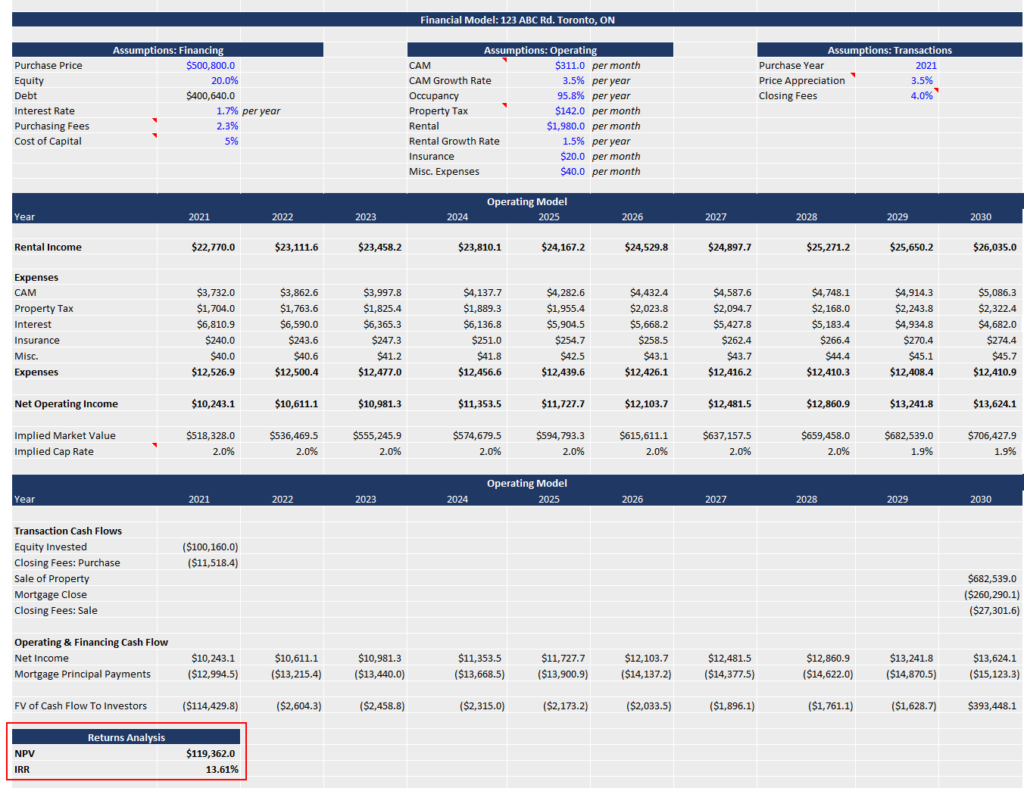

One of the most common concerns by those considering condos as investments is that rent doesn’t cover taxes/maintenance fees/mortgage, leaving them to subsidize the purchase and making the investment ‘cashflow negative’. A valid concern and something that was not the case up until a few years ago when capitalization rates on residential real estate became more suppressed. This model walks through...

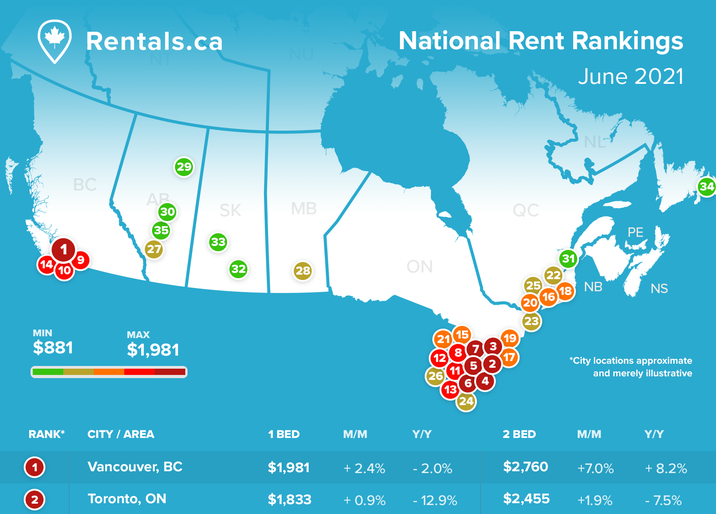

"The latest @Rentalsdotca National Rent Report is out. Average rent in Canada is up for the second consecutive month, Vancouver rises 2%, Toronto up 1.5%...