For every 1% increase in interest, real estate prices drop by 10%

Here is how I see this playing out in the GTA.

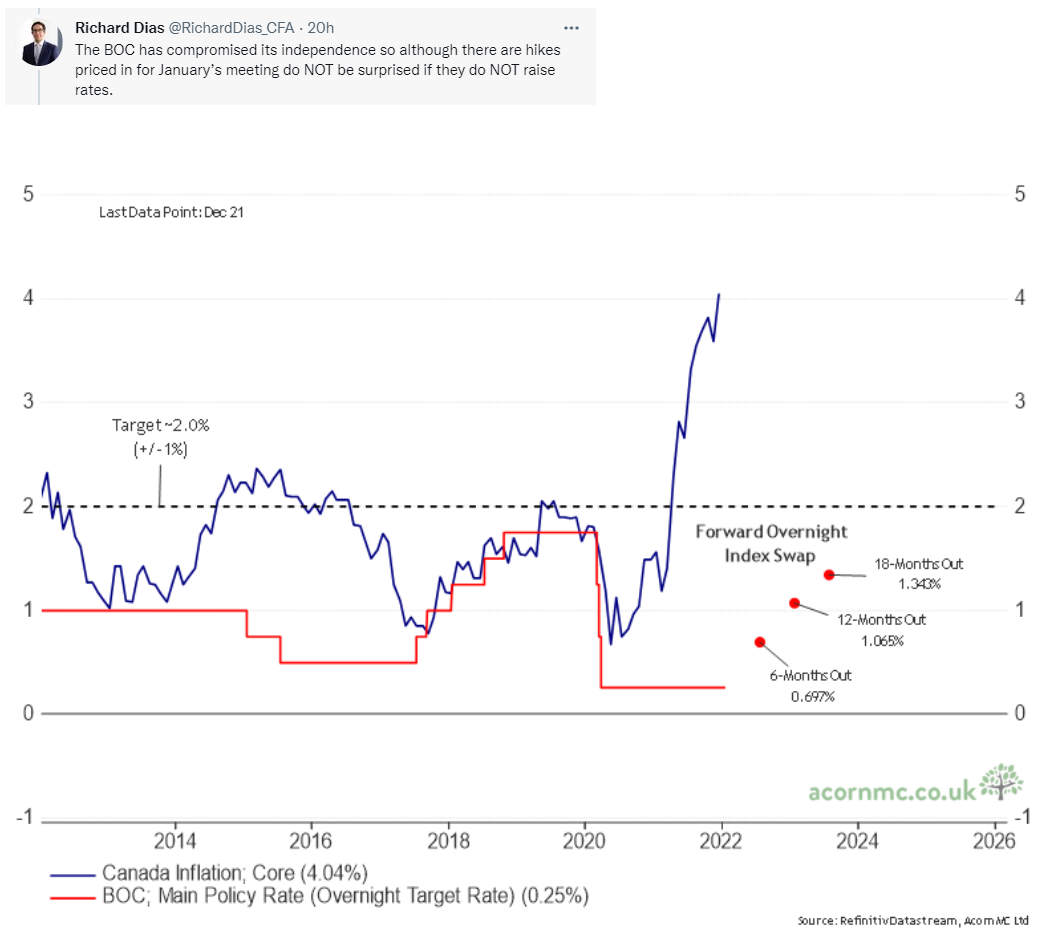

While a rate hike next week is unlikely to change market sentiment (if it happens), line of sight on hikes to follow can as the problem will compound the longer this is delayed.

If new listings continue to lag as we are in real estate gridlock due to affordability, even with a rate hike next week we will continue to see price increases, likely at a slower rate. Short of an external event, if the market feels BoC is serious about containing inflation, the most likely outcome is a sideways Real Estate market for the rest of the year, with the exception for condos.

2021 was the year of the suburban detached home (and it still is), 2022 is shaping up to be the year to benefit condo owners, downsizers, and multi property owners looking to take some profit in what is currently the most favourable sellers’ market we’ve had in decades.

Interested thread to follow for additional data points:

#toronto #realestate