Real Estate is in gridlock. Here is why:

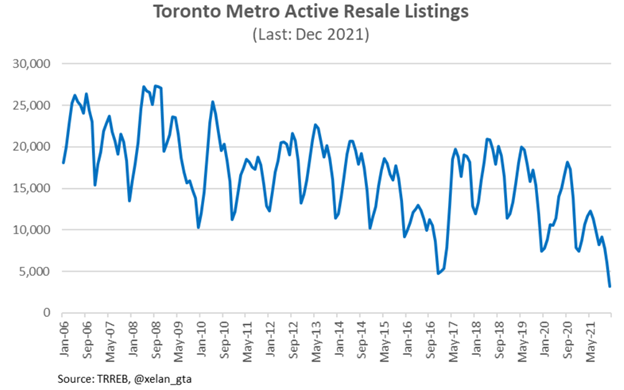

One of my favourite metrics of the Real Estate market is the active resale listings. I like this visual for the simple yet very easy to understand metric relative to history. We are looking at record low active listings in a city that has seen massive population growth over the last decade. In other words, if we considered population growth/home completions, this graph would look a lot worse and would be a lot more reflective of the current reality, but the current visual is clear, there aren’t enough homes being listed for sale relative to the demand for housing – this isn’t the punchline.

The bottleneck in active listings is simple: people can’t afford to upgrade. While media stories continue to focus on disparity between housing prices vs income being at an all time high, anyone on the ground floor knows buyers in today’s market aren’t buying based off high incomes, the vast majority are able to do so based on the wealth generated by the appreciation of their principal residence, which gets rolled over into the new property. To illustrate this point, assume someone in Markham with a townhouse wanted to upgrade to a single family detached home in Dec of 2019, they’d be looking at a 517k mortgage in addition to their current mortgage to complete the upgrade. Based on today’s prices, doing this same upgrade would require an 819k mortgage (58% more) even after you factor in the existing home appreciating at above average rates.

Existing homeowners are stuck, accumulated wealth from existing properties is only the starting point to upgrade, significantly higher incomes are now a requirement, not a ‘nice to have’. This will be the year of the “Downsizers” and multi property owners who take the opportunity to take profit. #toronto #realestate