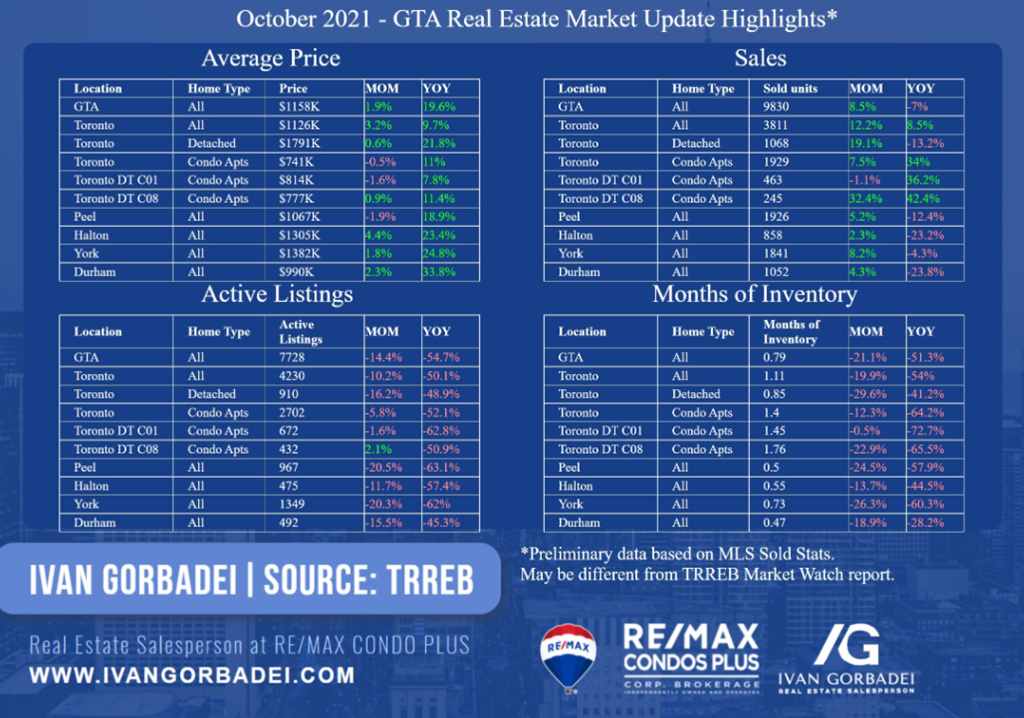

Every time we break a new record it seems there is no more room to go up, and yet here we are again looking at increasing price trends. Data prepared by Ivan Gorbadei shows all 4 leading indicators pointing towards higher prices. Aside from condos in the core there is further tightening in inventory. Prices are up and inventory is down month over month, making it an opportune time for sellers and a blood bath for buyers.

One of the main reasons why I believe we are likely to see further price increases is due to the recent rate hikes for fixed mortgages and the speculation that we are in for another 6-7 rate increases (each to be 25 bps) over the next 24 months. Whether this happens or not, no one knows, however here is what I know being on the ground floor working with buyers.

When a property search begins, motivated buyers get a mortgage “pre approval” through their mortgage broker or their bank branch. The rates offered at the time of pre approval are guaranteed for 90 to 120 days. With the recent increases in fixed mortgage rates at the end of October, buyers with past pre approvals at lower fixed rates are now even more motivated to make a purchase to keep the lower rate they have vs. letting the pre approval lapse and then start shopping with a higher rate. We’ve seen this playout before, buyers rush out to close on a property to lock in a lower fixed rate for their 5 year term, the question is at what cost? This will likely lead to a short term run up on prices over the next 30-60 days.

Variable rates remain unchanged.